Today, something significant happened in the gold market.... and it's not good news for the bulls, at least short term.

The current weekly (intermediate) cycle began on September 26th with a low price of $1535 became a left translated weekly cycle on December 22 when the count of days within the weekly cycle reached 63. The cycle's high of November 8th (Day 31) then became left of the cycle's center.

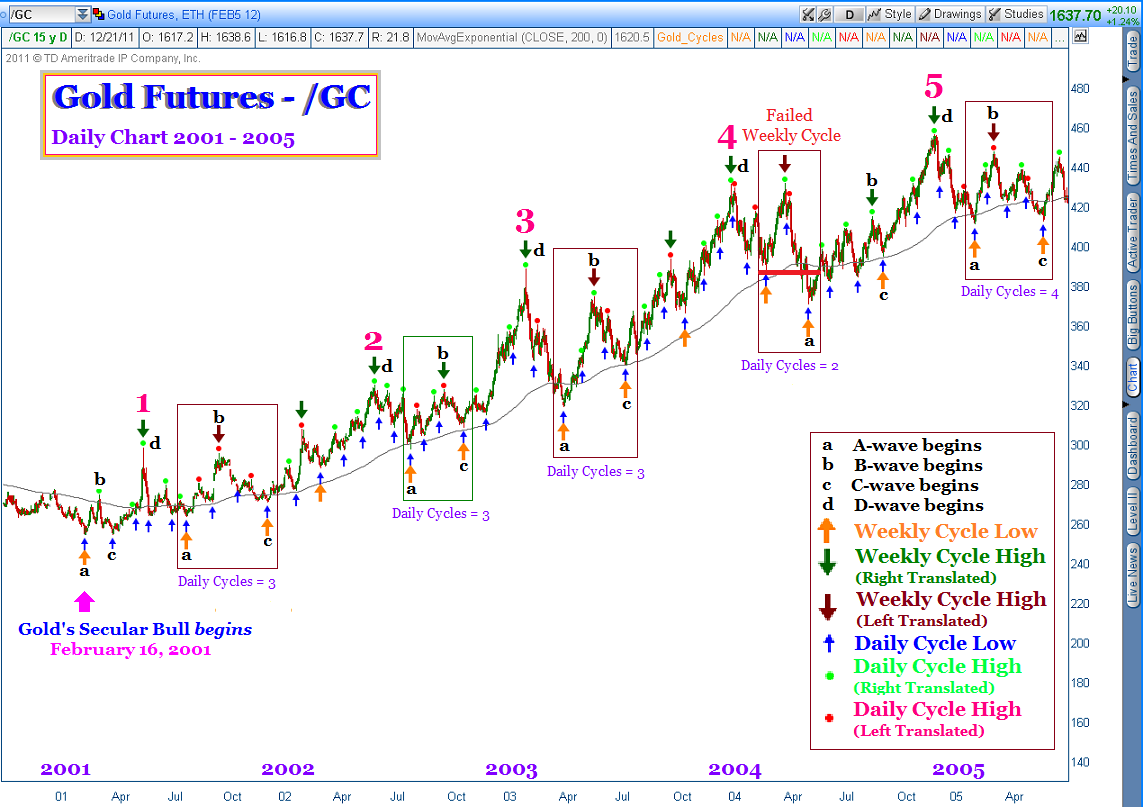

But as I recently pointed out in Gold's Secular Bull Cycles and Its ABCD Pattern, each and every C-wave top has been followed by a left translated weekly cycle except the 2002 C-wave. The odds therefore were very high that our current weekly cycle, which has followed the $1923.7 C-wave top of September 6th, would also be left translated.

However, the left translated cycles that have followed all but one C-wave, curiously, were not failed cycles - except for the early 2004 and 2008 C-waves. A failed weekly cycle is one in which the cycle bottoms lower than the price where it began.

Here is a daily chart of the 2003 - 2006 cycle data for gold.

The early 2004 C-wave was followed by a weekly cycle that was a failed weekly cycle. When a cycle fails price will continue to fall sharply and when it finally bottoms, the A-wave begins with a very powerful rally.

Here, let's take a closer look at the early 2004 example to see the failed weekly cycle in more detail.

In this case, the weekly cycle bottomed 7 or 8 days after the failure.

In 2008, gold investors were not so fortunate to simply endure a week or two for things to start getting better.

In this case, price sliced right through the failure line and kept going, only to decide to retest that price level (unsuccessfully) and then take everyone on a fantastic ride into outer space..... crashing for one week and soaring for the next..... seemingly over and over again.

Last summer I wrote about a post titled, Gold C-wave Tops and D-wave Retracements. My research detailed each of the 6 historic examples with measurements of D-wave price retracement of the C-wave that preceded it, trading day tally for each D-wave, and the relative speed in terms of trading days that each D-wave plummeted to reach key Fibonacci levels.

With today's breach of the current weekly cycle perhaps this would be an opportune time to refresh our memories on the kind of damage D-waves do to the price of gold.

The following chart shows the entire 2009 - 2011 C-wave that concluded September 6th and applies some Fibonacci measurements to this C-wave's $1058.7 rise above its $865 beginning.

It is a bit scary to see the historic retracements of the previous 6 D-waves and apply them to today's situation. We have a retracement to date of 38%. I would put the odds that gold has finished falling at about ZERO. And I would put the odds that gold reaches $1400 at 80 - 95%.

Some readers have been writing to inquire about my work on the four hour cycle of gold - and what it is telling us now, if anything. The following chart jumps us in a new direction with an overview of the past 180 trading days that www.thinkorswim.com platform makes available for the 4 hour time setting.

For starters, the blue counts are the bar lengths of each four hour cycle. These measurements have ranged from 57, 55 and 50 on the long side to 28, 31 and 36 on the short side.

The purple counts are a calculation of the number of trading days in each daily cycle at its concludion. These daily cycles have ranged from 14 to 28 days. My own research on the entire lot of daily cycles from 2001 to present is that daily cycles average 24 days.

The next chart zooms down the time frame to just the current weekly cycle.

Some quick things to note. There have been 3 completed daily cycles in this weekly cycle (18.8, 23 and 27.3 days each). Within each daily cycle we find the nested four hour cycles. The first two daily cycles had three nested four hour cycles. The third daily cycle had four. We have just begun a new daily cycle - literally at 8:00 am cst this morning. And that means we will have more nested four hour cycles before the conclusion of this daily and weekly cycle.

If you would like to study the number of four hour cycles that are nested within each daily cycle just look at the chart that preceded this one!

Well, getting down to the nitty-gritty now. Here is a chart of the four hour cycles up close with the TSI BUY/SELL signals below price.

We see that price has bounced after crashing through the failed cycle level of $1535 (as in the 2004 example), the slower trending TSI (25,25) has turned from red to green, indicating a likely change in trend direction, and the TSI (7,4) has signaled a trend line break BUY (green dot).

BTW, the small red/green dots above price locate the four hour cycle high - red is for left translated, green for right translated.

OK - so where do we go from here?

Lower, obviously. But maybe enough of a bounce in the very short term that I can keep a sale of my NUGT and AGQ positions from being too embarrassing. (lol)

If that does not work out for me I will stand aside and look the other way for awhile. It's a bull market, after all! Those of you who can wait - you are about the get the buy of a lifetime. Let's all keep an eye on it together, OK?

John

tsiTrader@gmail.com

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/quotes_special.gif)