First a brief update on Cardero Resources (CDY). I introduced this stock to readers on December 26 when it was trading for 95 cents. Though I did not purchase CDY (I set a limit price that was never hit) I am very pleased that many readers did buy the stock, as it closed today at $1.53. This daily chart updates the stock's subsequent performance and highlights what can happen when the overhead resistance of the 50 dma and 200 dma are overcome.

Click on any chart to ENLARGE

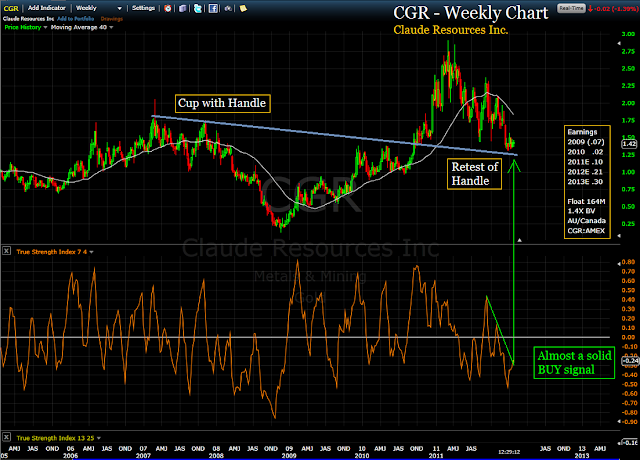

Today I purchased Claude Resources (CGR) for $1.46 per share. Having missed the strong run of CDY I decided to just get on board Claude Resources and be patient. Let's begin with a look at the weekly chart.

I've looked over a couple hundred miner charts to find this one. I was impressed with the cup with handle pattern and the recent/current retest of the handle. In a really ideal environment, such as I think is now developing in the mining stocks, the retest that pulled price down from $3.00 to nearly $1.00 in the space of a single year could act like a sling shot - energizing upward price movement when selling pressure is finally exhausted.

This chart of daily price movement shows that CGR currently has some of the same challenges as CDY had when I brought it to your attention. That is, overhead 50 dma and 200 dma resistance.

The stock has made it up through an initial price trend line of resistance just this week, but there are a couple others waiting overhead. The True Strength Index (TSI) indicator shows that sometime before the end of February we should have a break out of significance, up or down. Should price be able to navigate through the next 50 cents of landmines - up past $1.90 - there will be little if any resistance from there on, whatsoever.

If we take a look at a closer view of the daily chart we can see that CGR has some positives going for it at the moment. Two BUY signals have been given by the TSI - a trend line break and a ZERO crossover. Additionally a stealth positive divergence has been building for a number of weeks as price seems to be consolidating and at last dissipating the last of the downward momentum of the past year. Today we had our first test of the 50 dma and it's not surprising to see it fail on the first try. But I am quite sure there will be more attempts.

You may have noticed the earnings projections for Claude Resources that I put on a couple of the earlier charts. I found it nearly impossible to find another stock with more explosive projections: 2010 2 cents, 2011E 10 cents, 2012E 21 cents and 2013E 30 cents.

CGR has a smallish number of shares outstanding, with 164M. It is a Canadian company with all of it's mining operation in Canada. And best of all, for me anyway, is that it is currently priced at just 1.4X book value. That's cheap. There are a several other AMEX miners that trade with a lower price to book value ratio - CDY, KGC, AUMN, GSS, GBG, BRD - but the estimated earnings of these did not impress me as favorably as CGR.

In closing, here are a couple tidbits from my study. The first is from The Motley Fool (11-17-2011) and provides an overview of Claude's business/operation. The second tidbit shows that despite the stock's continual slide over the past six months, large institutional buyers have continued to load up on CGR.

Go get 'em!

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/quotes_special.gif)

Hi John, Thanks for all your articles. Yahoo shows institutional ownership for CGR as of 9/30/11 at 28.7% which comes to about 47M based on 164M shares outstanding. Data provided by Thomson Reuters. Do you think institutional ownership increased to 50% in Q4? Thanks. Bruce

ReplyDeleteHi Bruce,

ReplyDeleteI am still scratching my head to remember where I borrowed that chart from. Still looking and if/when I find it I will write that information here.

In the meantime, I'm looking harder at your question and finding this:

http://www.nasdaq.com/symbol/cgr/ownership-summary

says 32% as of 12/31/2001

http://quotes.barrons.com/CGR/ownership

instit. + funds seem to own about 30% of shares, if my math is correct

my Scottrade account reasearch says "Investment Managers - 48.2%..... Non-Institutional - 51.4%

I'll keep poking around between classes and see what else I can find out.

Thanks for all the analysis and insight.

ReplyDeleteJust wondering, are you concerned about CGR's P/E ratio?

Lone Star - CGR PE ratio?

ReplyDelete2011E 13.8

2012E 6.5

2013E 4.5

No, I am not concerned, but good question. Most Micro-Cap Gold miners do not even

have a PE because they have not made any money yet. Claude is in the minority of

those who have made money and thus have a PE. Indeed, this was one of my considerations

as I wanted to know that management had the 'where with all' to make a profit once it

got down to getting the ore out of the mountain.

Of much greater interest to me is the value of the company. The old accounting equation

Assets minus Liabilities. My thinking is that if a mining company has little or no debt

and the assets that they own free and clear are not being priced accordingly by the market

that represents an opportunity for an investor. Even more true if one believes that their

primary asset (gold) is going to appreciate over time. In that case, it is even better that

their asset is gold and not cash. And though not a primary consideration of mine, I do keep

it in the back of my mind that larger miners are having a tough time keeping their growth rates

and production of gold increasing. The way many of the bigger miners keep their production and

earnings moving forward is to acquire smaller companies that have what they want - proven gold

priced at a fire sale.

Hi John,

ReplyDeleteI frequently read you site and you really do excellent analysis, so thank you!

This may sound like a stupid question but sometimes I read your TSI setting to be 7,4 and other times 4,7 on freestockcharts pictures that you post.. are these the same? Short period 4 long period 7 or have I missed something? I'm very excited to start trying the TSI myself, so far I've mainly used it as a complement to my other tools (cycles and TA) but with the 13,13 config.

Regards

Nick

Hi Nick - that is a question I answer all the time and I should probably figure out a way

ReplyDeleteto include it in some of my pages about using the TSI for BUY/SELL signals.

Anyway, the TSI compares two moving averages. In this case, the 4 and the 7. The math has no

idea which of the two numbers is larger, nor does it care. Try it both ways and you will see the

identical results!

Thanks for the clarification!

ReplyDeleteThat's what I've been seeing, but felt I had to ask so I did not miss out on something.

I'm planing on taking a weekend soon going thru the TSI in depth, so might come back with a few questions.

Have a great weekend!

/Nick

Thanks for the feedback - I should have read the post thoroughly before commenting.

ReplyDeleteI mentioned P/E because the Google and Scottrade summaries both list EPS as 0.04 and P/E as 35-36. For miners that do list P/E that seemed on the high side, and Google's chart dates back to 2004, so I didn't know whether to cut them the same slack as a newbie.

But Scottrade's earnings page shows a quarterly breakdown for 2011 EPS (with a Q4 estimate of 0.03) that adds up to 0.11, matching your 2011 figure.

http://research.scottrade.com/qnr/Public/Stocks/Earnings?symbol=CGR

Here's a table of gold miner company valuation metrics I bookmarked previously that happens to include Claude, by the way:

http://www.goldminerpulse.com/vGold.php

In CGR today at $1.41, sold CDY for over 40% profit. Thank you!

ReplyDeleteWhy did you sell CGR today? What's changed? I'm holding for two dollars.

ReplyDelete