Tonight's post will revisit the subject of sentiment, look at how the current sentiment of both gold and the stock market compare with recent price action and also consider the momentum that exists going into tomorrow's Friday trade.

*

This first chart is today's put/call ratio from Schaeffer's Research for the gold ETF (GLD). No surprise to us, those pesky gold bears have found themselves on a very hot frying pan since the July 28 bottom in Gold....and have been fleeing to the bull camp as fast as they can get there.

*

Indeed, such a large number of bears ultimately threw in their towels so fast, one has got to wonder if there are many undecided ones left. If not, then it would be a good time now to reset sentiment with a price correction in gold.

*

Click on the charts to ENLARGE

*

The second chart is an up to the minute look at the 4 hour chart of cash Gold. What is apparent is that when momentum begins to roll over, price usually takes quite a tumble. We seem to be in that position currently, but momentum is still quite high above ZERO. It will be interesting to see how much higher, if at all, gold can go from here.

*

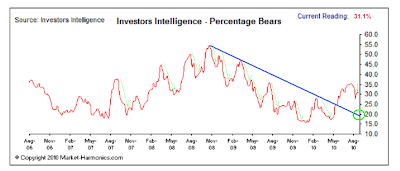

The third chart is this week's data released by Investor's Intelligence today. It shows in the last week fully 5% of the bulls decided to rejoin the bear camp.

*

The orange circle coincides with the SP-500 bottom at 1010. With today's data we calculate that bullish sentiment has barely budged since the 1010 bottom, yet the SP-500 is already some 70 points higher.

*

What this tells me is that the natural swing from the bearish extreme to the bullish extreme in sentiment (and therefore price) has not nearly run its full course. ie. there is much more upside and little risk on the downside.

*

This chart gives you a sense of the size of sentiment swings that have been normal over the past 4 years. Most swings in sentiment have been in the 15-19% range. Thus far, we have only progressed in bullish sentiment by 5%. My hunch is that before this stock market rally is complete, bearish sentiment will retreat from its current reading of 31.1% to something in the neighborhood of 20.0%.

Our final chart this Thursday evening is a 4 hour chart of the SP-500. The most striking thing to me, as I consider the chart from a momentum standpoint, is to see a HUGE positive divergence ready to take price higher at any time now. Price is at the retest of 1077, but momentum is almost at the ZERO crossover - not 10,000 leagues beneath the sea as before.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/quotes_special.gif)

Hi,

ReplyDeleteAre you out of your TNA position yet?

Thanks.

Nope. I hold the entire TNA position and not going to sell any before 41, the rest at 45 if that looks good.

ReplyDeletehttp://thetsitrader.blogspot.com/p/my-tsi-trading-record.html

Shows you what stocks I own now and have owned in the past. You can always look there because I update it within minutes after any Buy or Sell trade....so that page is always perfectly up to date.

Fung, it is possible that we could maybe have a few more down days in the stock market. Heck, anything is possible, after all. But I will not sell TNA then either, if that is what you are wondering.

That is good to know. As always, appreciate your analysis.

ReplyDeleteWould you mind telling me where I can locate the Volume put / call ratio for GLD / Comex Gold chart, please?

ReplyDeletehttp://www.schaeffersresearch.com/streetools/indicators/equity_volpcratio.aspx

ReplyDeleteJust input the ticker symbol of interest (GLD)

Thanks, John. Love your instant reply. Many Thanks!!

ReplyDeleteGreat Analysis John! I have been following your market sentiment research articles and really appreciate the insight and concept. Keep it up!

ReplyDeleteI noticed that the equity put/call chart is the put/call volume.

ReplyDeleteI assume this means it is the level of put and call interest rather than the ratio of puts to calls.

Does this change your analysis?

Anon - no, I think that particular chart shows the volume of puts and calls traded and then calculates the ratio of those two measurements.

ReplyDeleteAt Schaeffersresearch.com you can view a stock's put/call volume, put/call configuration, put/call open interest, short interest and a proprietary composite measure of the implied volatility of a stock's options.

This represents 5 different screens of data, each providing a unique view of a stock's "otherwise unseen" dynamics.

Anon - sorry, I forgot to answer your second question about possibly changing my analysis.

ReplyDeleteGold has topped. I think there is no question about that at this point. I look for gold to now retrace about 50% of the most recent rally - taking it to $1200. This will fill in the gaps that are still open in GLD. I now think there is an excellent chance that smart money will run the stops placed just below $1200 - intraday - so they can accumulate as many shares as cheaply as possible. The old 'scare the little guy' out of his shares trick. Gold price will probably then just reverse higher as soon as the smart money has fattened up to their satisfaction.

The stock market could end up dropping even further this upcoming week, sorry to say. The US Dollar has completed a 38.2% retracement of the recent down leg. Should it try for a 50% retracement this week, stocks will drop further. I don't think this will last more than 3-4 days, if it happens, with gold falling to below $1200 simultaneously, and then we should be all set for the fall rallies in both the stock market and gold.

We are now in the phase where the little guy is going to be mentally challenged to hold on to his positions. If you make it through next week with your holdings YOU HAVE A LOT OF GOOD TIMES TO LOOK FORWARD TO!

John,

ReplyDeleteThanks for your blog.I would appreciate an analysis of SLW and SLV.Thanks for your consideration.

SLV and SLW

ReplyDeleteWell, without getting into technical details, both are now on short term sell signals. My hunch is that by the end of this upcoming week they will have both bottomed, along with gold and the stock market.

Is it worth it to sell on Monday then rebuy 4 days later? Beats me. That's up to you.

I would just point out that until gold reaches $1200 and flushes out the weak hands there, there will be continued selling pressure on both SLV and SLW. If you want to eyeball a price target for either, keep the lower Bollinger Band in mind.

If you own either or decide to buy either you should get more than an adequate return on your investment in September (!)

I hope these thoughts help you make the right decision for your investment style.